Your Questions Answered

Find answers to some commonly asked questions about EZShield Check Fraud Protection. If you do not find your question here, please contact us and we will promptly assist you.

About

- Who is EZShield?

- How long has EZShield been in business?

- How many customers does EZShield protect?

- What is the EZShield Promise?

- What is End2End Defense®?

Identity Restoration

- What is Identity Restoration?

- Can EZShield alert me if someone takes money out of my checking account or makes a fraudulent purchase with my credit card?

- What is an Identity Theft Event?

- Does this include reimbursement of the money stolen?

- By signing a Limited Power of Attorney, to whom am I giving permission to access my information?

- Will Identity Restoration apply if the identity thief is a family member or roommate?

- What do I do if my information is compromised, or I have fraud?

- What are Education and Preventative Measures?

Check Fraud Protection

- What is EZShield Check Fraud Protection?

- Will I have to file a police report?

- Do I have to notify my bank about the fraud?

- What if my bank reimburses me after EZShield sends the money?

- Why do I have to send a Power of Attorney?

- How can I get Terms & Conditions?

- Is there a monthly fee?

- Can I renew my EZShield service on my checks?

- What if someone has checks printed using my account information with the same check series. Are those numbers eligible?

- What is Check Replacement?

- What does the advancement apply to?

General Information

- What does Check Fraud Protection do for me that my financial institution doesn’t already?

- Why do I need this service if the bank already reimburses within 24-48 hours?

- I don’t understand why a third-party is needed. Isn’t this is a fight between the bank and the customer?

- Uniform Commercial Code Articles 3 & 4 says the liability is on the financial institution and that the customer is already protected.

- How do I know if I have EZShield?

- How do I get this service?

- How much does it cost?

About

EZShield is your complete fraud protection solution, offering a comprehensive suite of products and services to minimize the risks associated with fraud and identity theft and maximize financial data security. Financial institutions and similar organizations partner with EZShield; named the Best Overall Identity Protection Services Leader two-years-running, to enhance their offerings and provide added protection to their customers. With EZShield, customers have access to fraud and identity theft products and services to protect their name, identity and assets in a safe, convenient and easy way.

Return to Top

2. How long has EZShield been in business?

EZShield has been in business since 2001.

Return to Top

3. How many customers does EZShield protect?

EZShield has a proven track record in protecting over 30 million customers against identity crimes.

Return to Top

4. What is the EZShield Promise?

EZShield will continue restoring a customer’s identity on their behalf either until the records identifying the fraudulent transactions associated with the Identity Theft Event are corrected, or until EZShield reasonably determines that further efforts to revise such records would not be successful. When EZShield determines the circumstances of your case put your identity at a continued risk for further Identity Theft Events, EZShield will provide additional complimentary identity theft protection services to help prevent future fraud.

Return to Top

5. What is End2End Defense®?

A three-part fraud resolution process that includes (1) discovery; (2) isolation/restoration; and (3) prevention. EZShield has designed End2End Defense to help the customer take necessary steps to help prevent fraud or identity theft from happening again.

Return to Top

Identity Restoration

1. What is Identity Restoration?

Identity Restoration provides you with access, through a dedicated 800 number, to a Resolution Specialist who will guide you in assessing any fraudulent situation. The specialist will explain what measures you should take to protect yourself from an Identity Theft Event. If your identity was compromised, the specialist will work with you to determine what steps are needed to repair the damage. They will work on your behalf to communicate to government agencies, credit bureaus and law enforcement regarding the identity theft and help restore your identity.

Return to Top

2. Can EZShield alert me if someone takes money out of my checking account or makes a fraudulent purchase with my credit card?

No, EZShield cannot see your account activity for your checking accounts or credit cards. Most financial institutions provide alerts for such transactions, EZShield recommends taking advantage of those services.

Return to Top

3. What is an Identity Theft Event?

"Identity Theft Event" means, the fraudulent misappropriation and use of Customer's name, Social Security number, credit card number(s) or other Protected Identity Elements in any manner that adversely affects any public records or credit reports concerning the Customer.

Return to Top

4. Does this include reimbursement of the money stolen?

No, EZShield does not reimburse for the fraud. Rather, we advance the funds associated with the check fraud while your bank investigates the fraud and determines whether to reimburse you.

Return to Top

5. By signing a Limited Power of Attorney, to whom am I giving permission to access my information?

The Limited Power of Attorney will provide your dedicated EZShield Resolution Specialists with access to only the records that are involved in resolving your case.

Return to Top

6. Will Identity Restoration apply if the identity thief is a family member or roommate?

Yes, as long as the appropriate documentation is completed, along with a police report.

Return to Top

7. What do I do if my information is compromised, or I have fraud?

If you suspect fraud has occurred, or fear your identity information has been compromised, you should contact your EZShield Resolution Specialist right away at . Your Resolution Specialist will immediately assess your situation and begin taking the necessary steps to help you restore your identity.

Return to Top

8. What are Education and Preventative Measures?

Timely tips/industry best practices that EZShield keeps track of to help safeguard consumers and businesses against identity theft and fraud. These educational resources are available on FightingIdentityCrimes.com.

Return to Top

Check Fraud Protection

1. What is EZShield Check Fraud Protection?

In the event of fraud, the Check Fraud Protection Program advances funds within 72 hours, to a maximum of $25,000 for all checks, regardless of the number of checks. Speedy advancement of funds keeps you burden free while giving your financial institution time to fully investigate and resolve the fraud event.

Return to Top

2. Will I have to file a police report?

Yes, along with other documents that will be sent to you.

Return to Top

3. Do I have to notify my bank about the fraud?

Yes, you must file a claim with your bank. EZShield is not insurance; we expedite funds to you while your bank investigates the fraud. We also assist in the resolution of the fraud by completing our End2End Defense resolution process.

Return to Top

4. What if my bank reimburses me after EZShield sends the money?

Then it is your responsibility to forward those funds to EZShield.

Return to Top

5. Why do I have to send a Power of Attorney?

This allows EZShield to do the heavy lifting on your behalf – disputing charges as necessary.

Return to Top

6. How can I get Terms & Conditions?

By visiting our website, or contacting us at 1-866-449-8818.

Return to Top

7. Is there a monthly fee?

No, there is no monthly fee or recurring charge. There is a one-time charge paid by your bank, if applicable, or yourself at the time your checks were ordered.

Return to Top

8. Can I renew my EZShield service on my checks?

You can renew your EZShield services when you re-order checks.

Return to Top

9. What if someone has checks printed using my account information with the same check series. Are those numbers eligible?

Standard: Advancement applies to forged signatures, forged endorsements, and altered checks. Advancement does not apply to counterfeit or reproduced checks. These would be counterfeit checks, and CFP Standard would not apply.

Premium: Includes counterfeit or reproduced checks in addition to forged signatures, forged endorsements, and altered checks. These would be counterfeit checks, CFP Premium does apply in cases of counterfeit checks.

Return to Top

10. What is Check Replacement?

If the customer should be forced to close the affected checking account due to fraud, EZShield will assist with the check replacement facilitation process. The Resolution Specialist works with the customer’s applicable bank or financial institution and the check printer, allowing the customer to get new checks and quickly resume their normal financial transactions.

Return to Top

11. What does the advancement apply to?

Advancement of funds applies to:

- Forged Signatures: Legitimate checks forged using the account holder's signature as the payer, resulting in a debit to the account holder’s checking account.

- Altered Checks: Legitimate checks that contain altered information such as the payee identification, check amount, or that are otherwise altered to benefit the party altering the check.

- Counterfeit Checks: A fraudulent reproduction of a legitimate check. (Check Fraud Protection Premium ONLY)

Return to Top

General Information

1. What does Check Fraud Protection do for me that my financial institution doesn’t already?

EZShield Check Fraud Protection advances funds associated with check fraud incidents within 72 hours. You probably never think about how a check works once it leaves your hands. When a check is cashed, more than one bank is usually involved. Merchants or other parties are often part of the process as well. When check fraud occurs, banks have a legal responsibility to perform a thorough investigation and determine who is responsible for the fraudulent check. Coordinating with other banks and companies takes time. Check Fraud Protection is focused solely on getting you back up and running, allowing EZShield to be as fast as we are. In many cases, we work with your bank for you, saving you time and trouble. From there, we can also work with you to go beyond a single incident, and provide advice and tools to help you avoid additional incidents.

Return to Top

2. Why do I need this service if the bank already reimburses within 24-48 hours?

While it is possible that your financial institution could advance your funds within two days, there is no guarantee that they will be able to. They need time to be able to investigate the fraud before they can determine if you will be reimbursed. This could take weeks and may leave you in a tough financial situation.

Return to Top

3. I don’t understand why a third-party is needed. Isn’t this is a fight between the bank and the customer?

EZShield exists to get you back on track as quickly as possible. We do not replace your bank, but rather fill in gaps so that you are advanced your lost funds within 3 days. Also, as experts in the field of fraud and identity theft protection, we keep up with the latest news and prevention tips to help you better protect your personal information.

Return to Top

4. Uniform Commercial Code Articles 3 & 4 says the liability is on the financial institution and that the customer is already protected.

You are protected by the UCC, but the UCC gives the bank “reasonable time” to investigate the fraud before they must decide whether to reimburse your funds lost to fraud. EZShield guarantees advancement of your lost funds within 3 days to get you back on your feet as quickly as possible. We also provide you with End2End Defense®, a 32-step recovery process to help prevent future fraud.

Return to Top

5. How do I know if I have EZShield?

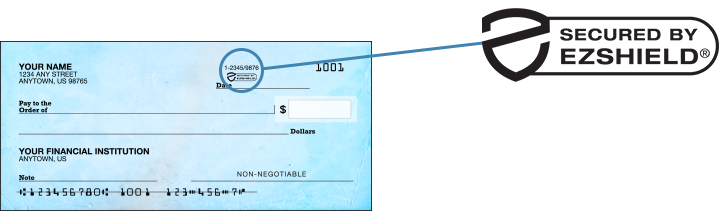

You know you have Check Fraud Protection if there is an EZShield logo on your checks. You should have also received an insert in your box of checks that describes the service.

Return to Top

6. How do I get this service?

Many customers obtain EZShield directly through their financial institution while others purchase our services through a direct-to-consumer check printer.

Return to Top

7. How much does it cost?

You may receive this service on a complimentary basis from your financial institution or for a small fee that your bank or credit union determines. When purchased through a direct-to-consumer check printer, the nominal cost is added to your checks.

Return to Top